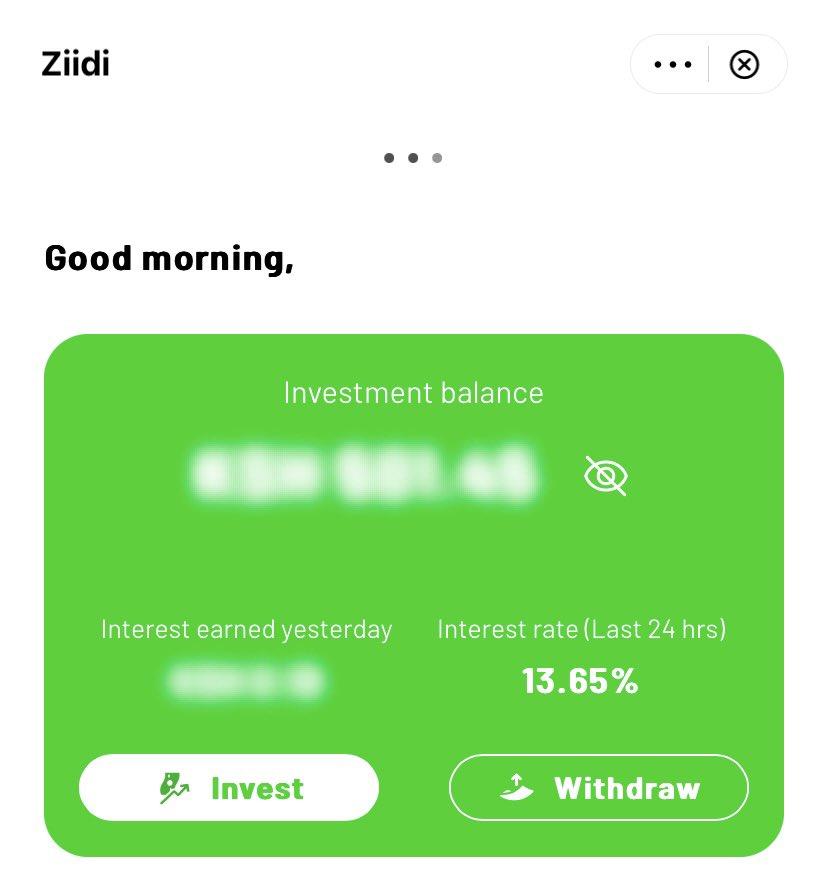

Safaricom has unveiled its latest financial offering, Ziidi, an MMF platform now opened to the public. Ziidi is designed with features similar to its predecessor Mali, but it enables users to seamlessly invest, earn interest on their investment, and manage the same account. Here is everything that you need to know about Ziidi, some of its features, and what sets it apart from Mali.

What is Ziidi?

Ziidi is Safaricom’s newest money market fund platform designed to make M-Pesa users invest small sums of cash with ease and earn an interest. What makes Ziidi different from other money market funds is that it is integrated into the Safaricom ecosystem, thus making it very easy to access for M-Pesa users, with a very low entry barrier of only KES 100.

Unlike most MMFs, which may require banking relationships or some mobile apps, Ziidi operates right inside the M-Pesa application, making it more accessible to the general public in Kenya. With an entry barrier as low as KES 100 and no transaction fees, Ziidi positions itself to become an accessible solution for individuals who want to grow their savings.

Key Features of Ziidi:

Invest and Earn Interest: Users can deposit funds and earn competitive interest rates.

Locked Funds Option: This feature allows users to lock funds to avoid unplanned spending. However, locked funds do not accrue additional interest, and unlocking them requires a 72-hour waiting period.

Low Entry Barrier: Start investing with just KES 100.

M-Pesa Integration: Seamlessly deposit and withdraw funds via M-Pesa without any transaction charges.

Signing Up for Ziidi

Signing up to Ziidi is easy and accessible on the Safaricom mini-apps platform. There were reports in the initial days of Mali users getting an error while trying to sign up for Ziidi. This seems to have been sorted, and users can now hold accounts on both platforms simultaneously.

Steps to Sign Up:

Open the M-Pesa app.

Navigate to the Ziidi mini-app.

Follow the prompts to register and add funds to your account.

Ziidi vs. Mali: What’s the Difference?

On first look and feel, the two platforms seem to blend into each other-from user interface to feature set. Both Ziidi and Mali target M-Pesa users with the same green-colored schemes, layout, and functionality. Yet, subtle differences do exist:

Similarities:

Both allow users to invest and earn interest.

The minimum investment amount is KES 100.

No transaction fees for deposits or withdrawals.

Differences:

Locked Funds: Ziidi offers a “Locked Funds” feature, which Mali lacks.

User Accessibility: Ziidi appears to have resolved initial accessibility issues, allowing simultaneous use with Mali.

The Locked Funds Feature: A Closer Look

Ziidi’s standout feature, “Locked Funds,” allows users to set aside money for financial discipline. Here’s how it works:

Funds can be locked indefinitely.

Unlocking requires a 72-hour waiting period.

Only the entire locked amount can be unlocked, not partial amounts.

While this feature promotes disciplined saving, the inability to earn interest on locked funds may deter some users.

Safaricom’s Strategy: Coexistence or Competition?

Having two almost similar MMF platforms under the same Safaricom umbrella raises a number of questions regarding user clarity and trust. Safaricom needs to clarify whether Ziidi and Mali are competing products or if one will be phased out in due course.

Clear communication of the long-term strategy for both platforms, and distinguishing their value proposition, may help in gaining user confidence and reducing confusion.

The launch of Ziidi is a promising step by Safaricom in expanding its financial services, but the duplication with Mali creates confusion that Safaricom needs to address. For now, users can enjoy the flexibility of having accounts on both platforms, exploring their unique features, and deciding which suits their needs better.

If you’re already on Mali, signing up for Ziidi can be a decent experiment. We will continue to monitor the performance, rates, and users’ feedback on both platforms for future reporting. Their next moves by Safaricom will show whether these two platforms coexist peacefully or evolve into a common solution.